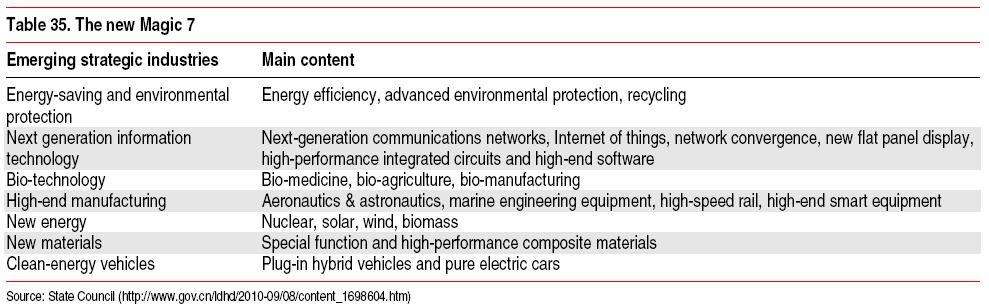

Are the days counted for China’s top-down macro economic decisions and for its state-owned monopolies? The next 5-year plan proposed by the Chinese Government focuses its attention on new energy and clean-energy cars. According to China Daily the government intents to ‘speed up new energy development and promote clean and efficient use of traditional energy, develop hydroelectric and nuclear power, and increase strategic oil reserves’.

Alongside new materials, high-end manufacturing, next generation information technology, and biotech, these industries form part of the “new magic 7” emerging strategic industries. (The old magic 7 consisted of national defence, telecom, electricity, oil, coal, airlines, and marine shipping.) It appears that the new magic 7 are more focused on bottom-up drivers and allow companies to use their ‘innovation’ process to drive capital allocations.

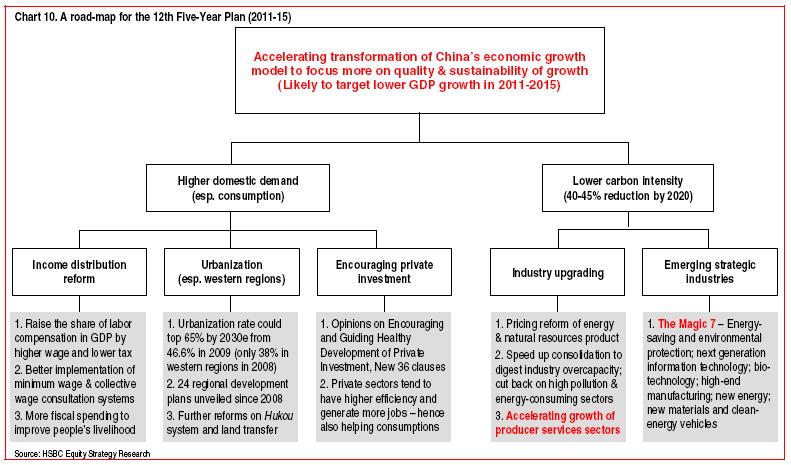

Ahead of the Chinese party conference, HSBC published a report titled ‘China’s next 5 year plan – what it means for equity markets‘ which investigates the new proposal in some detail. Specifically, the overall objective of the 12th five year plan (2011-2015) lies in the pro-rate increase in domestic demand to total demand and secondly, and as importantly, the overall reduction of the carbon footprint (CO2) by 40%-45% by 2020.

Further, the proposal projects that urbanisation will march on. HSBC estimates that a further 200-300m people could be urbanized over the next 20 years. If the hukou or registration simplification process moves in line with this shift, the projection suggests that consumption should increase significantly. The caveat here is that the property market development should ensure that the property bubble itself can be contained and price movements are more gradual going forward.

More importantly, there appears to be a continued drive to allow private capital to compete in what once were state monopolies or controlled industries. This should be great news for China focused private equity funds. From our view, there are still many low hanging fruits to be harvested by the largest funds in the region, including John Zhao’s Hony Capital for example. The investment pace has slowed a little since 2007 but funds are still putting capital to work. We need to wait and see whether some assets were overpriced and IRRs for Investors will be meaningful. Our views is that funds that put money to work throughout business/ macro cycles will do well for the time being.

We also note the drive to reduce high pollution and high energy consuming industries. For one, any energy price subsidies should be reviewed to allow a ‘fairer’ market price. Regrettably we feel that this process will take longer than currently proposed. We see a risk that some local producers/ polluters input cost competitiveness may be at risk on the global stage. In particular, pharmaceutical, the glass and other high water/power consuming sectors could lose some of their appeal. Can the government afford this – yet?

Certainly, the governments objective to double or indeed triple per capita income can only be a welcomed target. With that, domestic consumption levels should raise dramatically allowing for more propensity to consume (let’s hope little will be used for gambling!). Overall, the plan is intriguing and we look forward to seeing particulars.

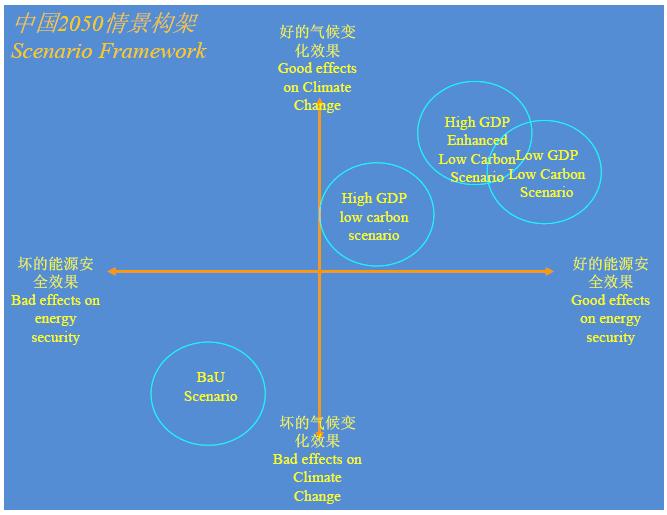

To sum up, the China Council for International Cooperation on Environment and Development (CCICED) suggests four scenarios for a low carbon economy until 2050. Although not that specific yet, it demonstrates the authorities focus on renewable energy and commitment to cleantech. The four scenarios proposed split into four categories: (i) BaU (business-as-usual) under high growth rate (BaU), (ii) Low Carbon Scenario under high growth rate (HCL), (iii) Enhanced Low Carbon Scenario under high growth rate (HELC), (iv) Low Carbon under high growth rate (LLC). See the link above for more details.

2 comments

Comments are closed.